- #Us savings bond program for mac serial

- #Us savings bond program for mac full

- #Us savings bond program for mac software

- #Us savings bond program for mac series

- #Us savings bond program for mac free

#Us savings bond program for mac free

Free version is an option for more people than competing free versions. Straightforward interface that’s easy to use.

#Us savings bond program for mac software

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2015/06/17/report-recommends-end-to-canada-savings-bonds-program/canadasavings.jpg)

This increases your chances of over-withholding, which can lead to a bigger tax refund. Specifying more income on your W-4 will mean smaller paychecks, since more tax will be withheld. Is it true the less you make the more you get back in taxes? If 30 percent of your time on the phone is spent on business, you could legitimately deduct 30 percent of your phone bill. If you’re self-employed and you use your cellphone for business, you can claim the business use of your phone as a tax deduction. What percentage of my phone bill can I claim on tax? This is even if your total claim for work-related expenses is more than $300 which includes your laundry expenses. If your laundry expenses are $150 or less, you can claim the amount you incur on laundry without providing written evidence of your laundry expenses. Municipal bond income is also usually free from state tax in the state where the bond was issued. * You will, however, have to report this income when filing your taxes. Income from bonds issued by state, city, and local governments (municipal bonds, or munis) is generally free from federal taxes.

#Us savings bond program for mac series

For example, if you earned $1,200 in interest on a Series E bond and your tax rate is 28 percent, your tax on the bond is $336, or $1,200 times. Multiply the interest earned on the bond by your federal tax rate. The income from taxable bond funds is generally taxed at the federal and state level at ordinary income tax rates in the year it was earned. The interest generated by bond funds is typically calculated daily, but paid out to investors monthly. Is bond interest taxed as ordinary income? Also, interest on Series EE and I savings bonds is usually exempt from state and local taxes.

#Us savings bond program for mac full

Backed by the full faith and credit of the United States government, the interest from these bonds is tax-free if used for qualified higher education expenses. Are savings bonds tax exempt for education?Īdvantages. To qualify for this program, the savings bonds must be Series EE or Series I bonds issued after 1989. Which US Savings Bonds are eligible for the education savings bond program?

#Us savings bond program for mac serial

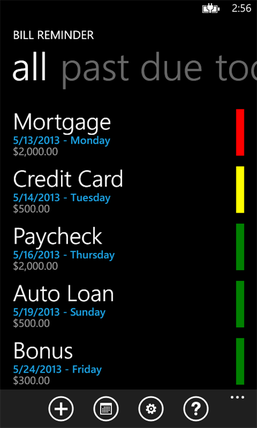

SBW file is the financial data file created by the program Savings Bond Wizard of the US Treasury that stores financial records including denomination, serial number, purchase date, interest, projected values and yield. Treasury redemption files without any modification. Treasury and imports inventories from this program. It has similar functions as Windows application, Saving Bonds Wizard, which was distributed by U.S. It helps you to manage your individual bonds and the entire inventory at the same time. It keeps a record of your savings bonds and enables you to keep track of the performance and redemption value of your bonds in U.S. It is a free software that supports Linux and POSIX systems. Gbonds is a savings bond inventory application for GNOME.

0 kommentar(er)

0 kommentar(er)